As India marks a decade of the Startup India initiative, the entrepreneurial landscape has shifted from a burgeoning trend to a structural pillar of the national economy. With over 200,000 DPIIT-recognized startups now dotting the map, the “Valley of Death”—that perilous gap between a brilliant idea and a commercial product—remains the most formidable hurdle for founders.

Enter the Startup India Seed Fund Scheme (SISFS). With a reinforced corpus and a streamlined digital interface, the 2026 iteration of the scheme is more than just a grant; it is the primary engine for “Viksit Bharat,” designed to turn local prototypes into global players.

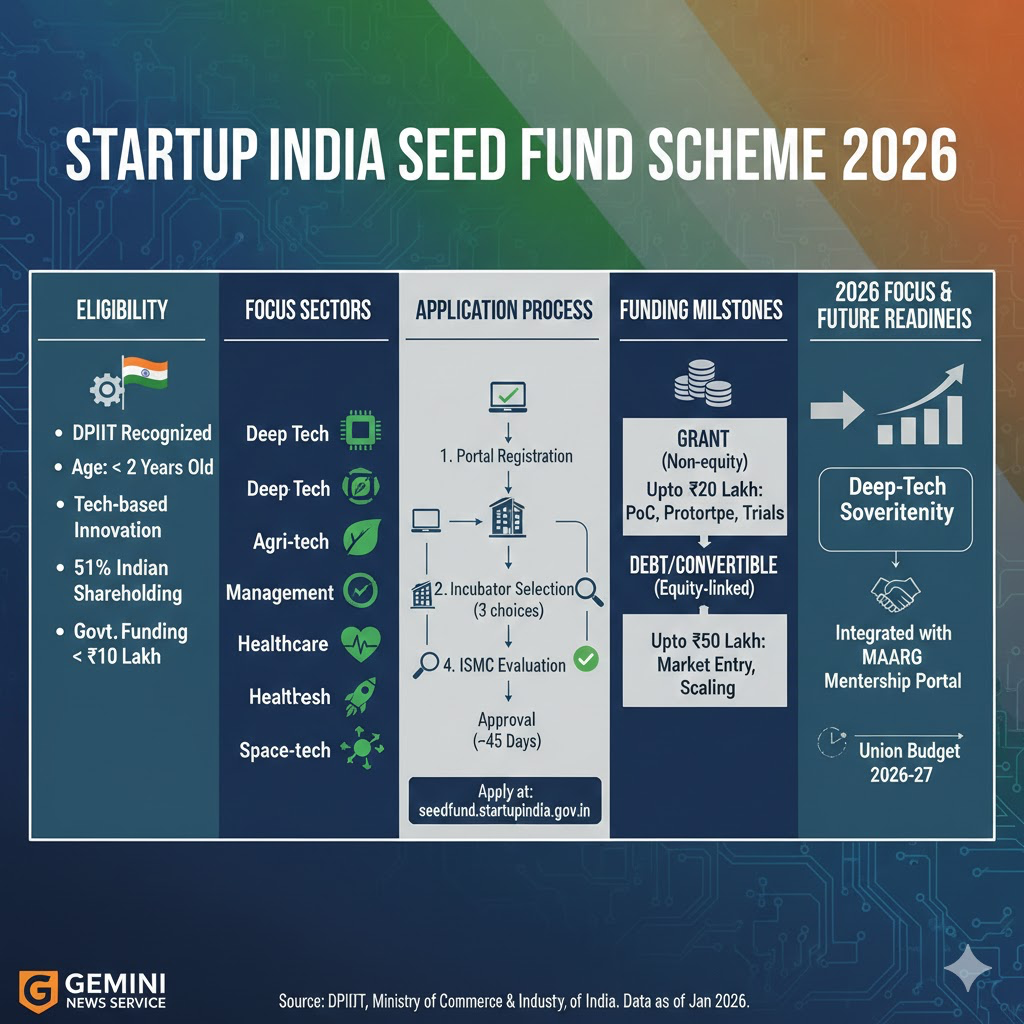

Decoding Eligibility: Is Your Startup Ready?

For founders looking to tap into the ₹945-crore corpus, the entry gates are specific but fair. In 2026, the Department for Promotion of Industry and Internal Trade (DPIIT) has maintained a sharp focus on early-stage innovation.

- DPIIT Recognition: Your entity must be recognized by the DPIIT. This is the “passport” to the entire ecosystem.

- The Age Factor: The startup must have been incorporated not more than 2 years ago at the time of application.

- Innovation Quotient: The business must leverage technology in its core product, service, or distribution model to solve a real-world problem.

- Ownership: At least 51% of shareholding must be held by Indian promoters.

- Prior Funding: To ensure the funds reach those who need it most, startups must not have received more than ₹10 lakh in monetary support from any other Central or State Government scheme (excluding prize money or subsidized workspace).

Pro Tip: While the scheme is sector-agnostic, the 2026 guidelines show a distinct preference for startups in Deep Tech, Agri-tech, Waste Management, Healthcare, and Space-tech.

The Application Process: A Digital-First Journey

The application process is entirely online and decentralized through incubators. Unlike traditional government loans, you don’t apply to a ministry; you apply to the experts who will mentor you.

- Incubator Selection: You can choose up to three incubators in order of preference. We recommend selecting incubators that align with your specific industry (e.g., choosing a Bio-Incubator for a medical device startup).

- The Pitch Deck: You will need to submit a detailed business plan, a video describing your product, and a clear roadmap of how the funds will be utilized.

- ISMC Evaluation: Your application is reviewed by the Incubator Seed Management Committee (ISMC). If shortlisted, you’ll be invited for a presentation.

- Approval: The committee typically decides on your application within 45 days of submission.

Funding Milestones & Disbursement

The SISFS doesn’t just hand over a check; it fuels specific growth stages through a milestone-based approach.

| Funding Type | Maximum Amount | Purpose |

| Grant | Up to ₹20 Lakh | For Proof of Concept (PoC), prototype development, or product trials. |

| Debt/Convertible | Up to ₹50 Lakh | For market entry, commercialization, or scaling up via debt-linked instruments. |

The Milestone Framework:

Disbursement is usually broken into 3 or more tranches. For example, a startup receiving a ₹20 lakh grant might receive:

- Tranche 1 (40%): Upon signing the agreement to start prototyping.

- Tranche 2 (30%): Upon successful completion of a functional prototype.

- Tranche 3 (30%): Upon beginning user trials or filing a patent.

Also read :https://newspixel.in/the-vertical-saas-2-0-revolution-indias-blueprint-for-global-niche-dominance/

Add theweeklynews.in as a preferred source on google – click here

Last Updated on: Tuesday, January 27, 2026 11:38 am by The Weekly News Team | Published by: The Weekly News Team on Tuesday, January 27, 2026 11:38 am | News Categories: News