India’s insurance industry is undergoing a significant transformation, driven by innovative InsurTech startups. These companies leverage technology to offer improved insurance services, enhance customer experiences, and streamline processes. This article highlights ten standout InsurTech startups that are reshaping the insurance landscape in India.

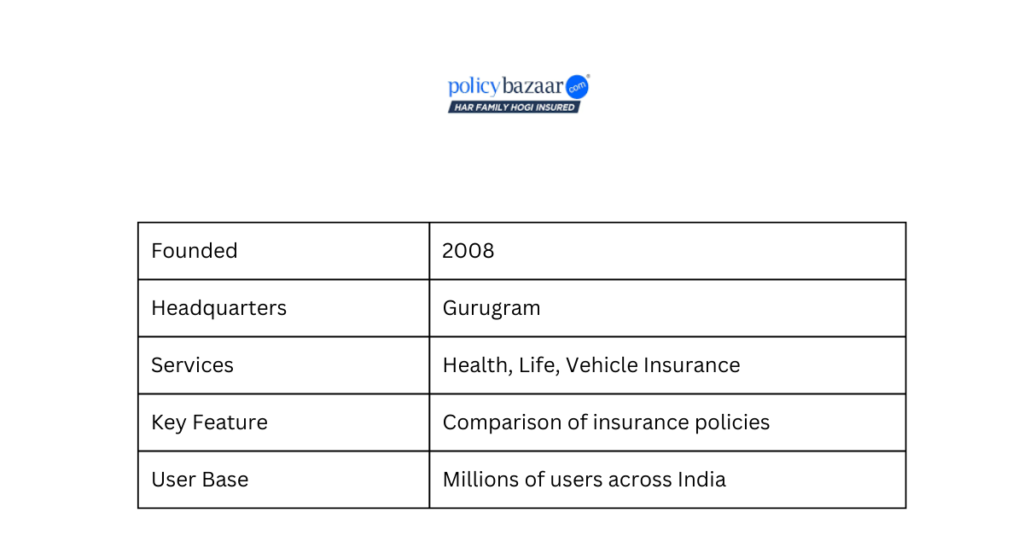

1. PolicyBazaar

Overview: Founded in 2008 and headquartered in Gurugram, PolicyBazaar is a leading online insurance aggregator, offering a wide range of insurance products including health, life, and vehicle insurance. Its platform allows users to compare policies and make informed decisions.

| ASPECT | DETAILS |

|---|---|

| Founded | 2008 |

| Headquarters | Gurugram |

| Services | Health, Life, Vehicle Insurance |

| Key Feature | Comparison of insurance policies |

| User Base | Millions of users across India |

PolicyBazaar-Top 10 InsurTech Startups in India

PolicyBazaar simplifies the process of buying insurance by providing a comprehensive platform for policy comparison.

2. Coverfox

Overview: Established in 2013 and based in Mumbai, Coverfox offers a seamless online platform for purchasing various types of insurance. It emphasizes user-friendly interfaces and transparency in insurance buying.

| ASPECT | DETAILS |

|---|---|

| Founded | 2013 |

| Headquarters | Mumbai |

| Services | Health, Car, Travel, Term Insurance |

| Key Feature | Transparent and easy-to-use platform |

| Specialization | Simplified insurance buying process |

Coverfox-Top 10 InsurTech Startups in India

Coverfox is known for its user-centric approach, making insurance purchasing straightforward and transparent.

3. Acko General Insurance

Overview: Founded in 2016 in Mumbai, Acko General Insurance operates as a digital-first insurer, offering motor, health, and travel insurance. It focuses on providing hassle-free claims and innovative insurance products.

| ASPECT | DETAILS |

|---|---|

| Founded | 2016 |

| Headquarters | Mumbai |

| Services | Motor, Health, Travel Insurance |

| Innovation | Digital-first insurance products |

| Key Feature | Hassle-free claims process |

Acko General Insurance-Top 10 InsurTech Startups in India

Acko General Insurance stands out with its digital-first approach, streamlining the insurance process from purchase to claims.

4. Digit Insurance

Overview: Established in 2016 and headquartered in Bengaluru, Digit Insurance offers a variety of insurance products including health, motor, and travel insurance. It is known for its straightforward claims process and customer-centric services.

| ASPECT | DETAILS |

|---|---|

| Founded | 2016 |

| Headquarters | Bengaluru |

| Services | Health, Motor, Travel Insurance |

| Key Feature | Simple claims process |

| Customer Focus | User-friendly and transparent services |

Digit Insurance-Top 10 InsurTech Startups in India

Digit Insurance aims to make insurance simple, focusing on transparency and customer satisfaction.

5. Toffee Insurance

Overview: Launched in 2017 and based in Gurugram, Toffee Insurance specializes in offering bite-sized, context-based insurance products. Its unique approach caters to specific needs such as cycle insurance, travel delay insurance, and more.

| ASPECT | DETAILS |

|---|---|

| Founded | 2017 |

| Headquarters | Gurugram |

| Services | Bite-sized, context-based insurance |

| Specialization | Niche insurance products |

| Innovation | Tailored, specific insurance offerings |

Toffee Insurance-Top 10 InsurTech Startups in India

Toffee Insurance brings a fresh perspective to the industry with its targeted, niche insurance products designed for specific scenarios.

6. RenewBuy

Overview: Established in 2015 and headquartered in Gurugram, RenewBuy provides a platform for comparing and purchasing various insurance policies. It partners with leading insurers to offer competitive options to customers.

| ASPECT | DETAILS |

|---|---|

| Founded | 2015 |

| Headquarters | Gurugram |

| Services | Health, Motor, Term Insurance |

| Key Feature | Comparison and purchase platform |

| Partnerships | Collaborations with top insurers |

RenewBuy-Top 10 InsurTech Startups in India

RenewBuy enhances the insurance buying experience by offering a comprehensive comparison and purchase platform.

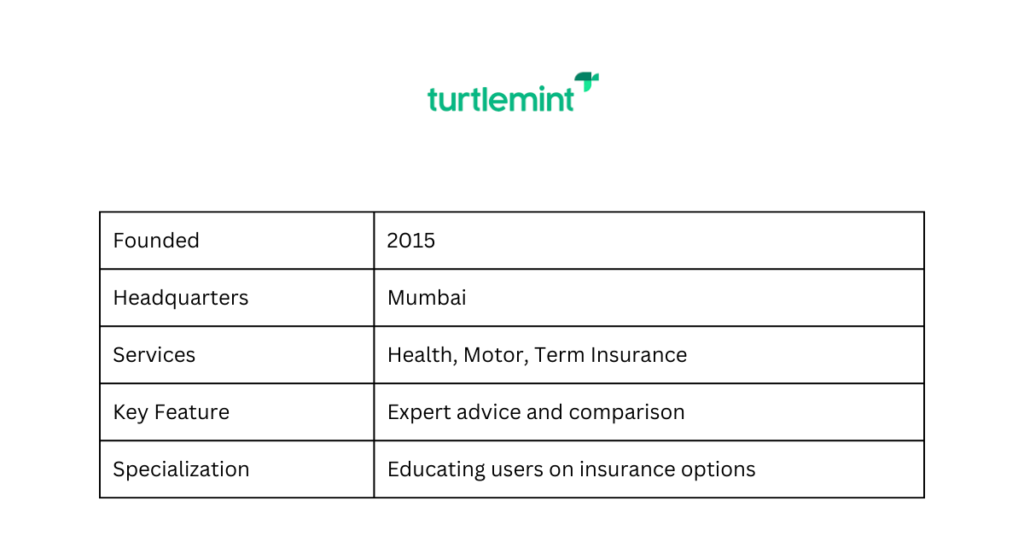

7. Turtlemint

Overview: Founded in 2015 and based in Mumbai, Turtlemint empowers users to make informed decisions through its online insurance comparison and buying platform. It provides detailed information and expert advice on various insurance products.

| ASPECT | DETAILS |

|---|---|

| Founded | 2015 |

| Headquarters | Mumbai |

| Services | Health, Motor, Term Insurance |

| Key Feature | Expert advice and comparison |

| Specialization | Educating users on insurance options |

Turtlemint-Top 10 InsurTech Startups in India

Turtlemint combines technology with expert insights to help users choose the best insurance policies.

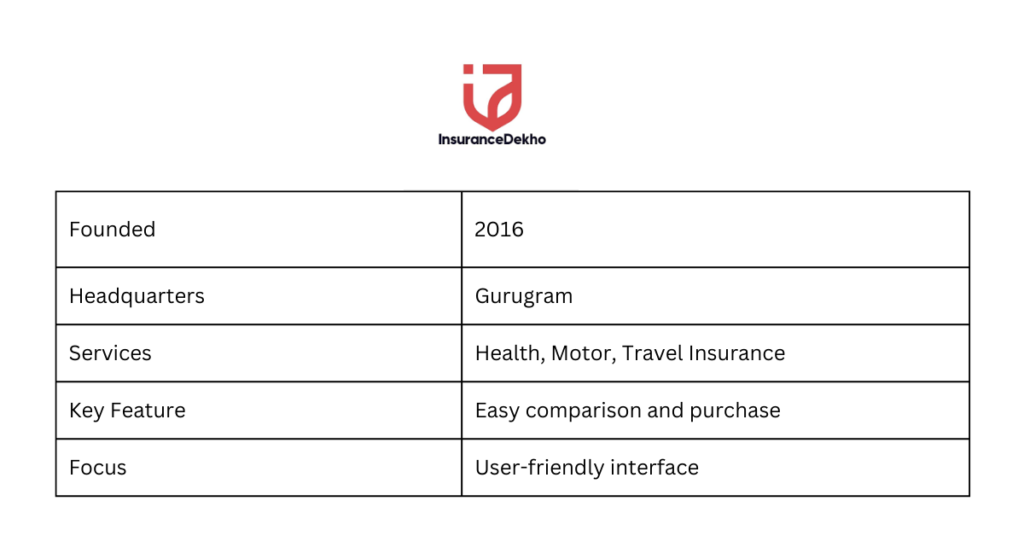

8. InsuranceDekho

Overview: Launched in 2016 and headquartered in Gurugram, InsuranceDekho offers an extensive platform for comparing and buying insurance policies. It focuses on providing a hassle-free, transparent insurance experience.

| ASPECT | DETAILS |

|---|---|

| Founded | 2016 |

| Headquarters | Gurugram |

| Services | Health, Motor, Travel Insurance |

| Key Feature | Easy comparison and purchase |

| Focus | User-friendly interface |

InsuranceDekho-Top 10 InsurTech Startups in India

InsuranceDekho simplifies the insurance process, ensuring users have a seamless and transparent experience.

9. GramCover

Overview: Founded in 2016 in Noida, GramCover focuses on providing insurance solutions for rural India. It partners with various insurers to offer crop, health, and livestock insurance to underserved communities.

| ASPECT | DETAILS |

|---|---|

| Founded | 2016 |

| Headquarters | Noida |

| Services | Crop, Health, Livestock Insurance |

| Target Market | Rural communities |

| Innovation | Tailored rural insurance solutions |

GramCover-Top 10 InsurTech Startups in India

GramCover addresses the unique insurance needs of rural India, providing essential coverage to underserved communities.

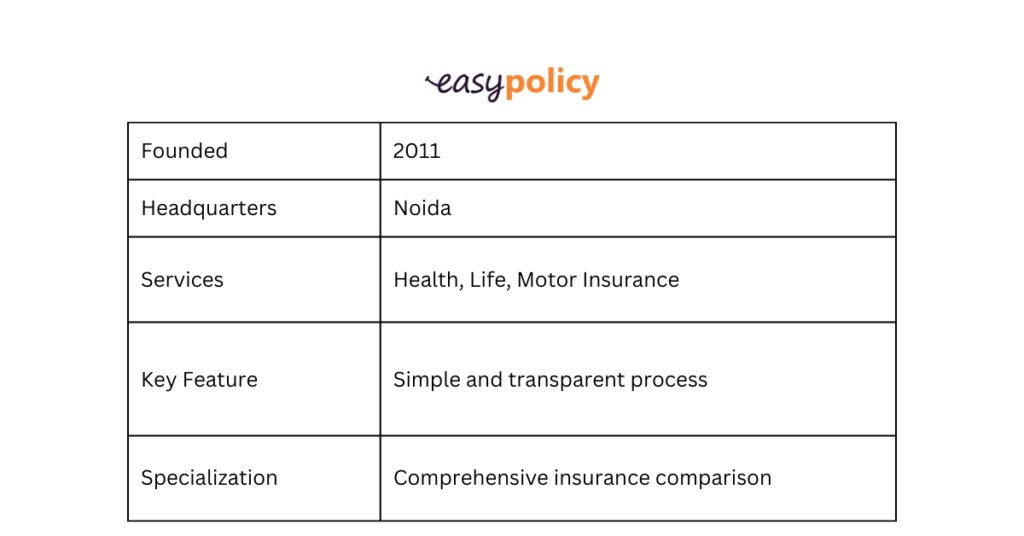

10. EasyPolicy

Overview: Established in 2011 and based in Noida, EasyPolicy offers a user-friendly platform for comparing and purchasing a wide range of insurance products. It emphasizes simplicity and transparency in the insurance buying process.

| ASPECT | DETAILS |

|---|---|

| Founded | 2011 |

| Headquarters | Noida |

| Services | Health, Life, Motor Insurance |

| Key Feature | Simple and transparent process |

| Specialization | Comprehensive insurance comparison |

EasyPolicy-Top 10 InsurTech Startups in India

EasyPolicy aims to make insurance buying straightforward and transparent, offering a wide range of products for comparison.

Frequently Asked Questions (FAQs) about InsurTech Startups in India

Q: What is an InsurTech startup?

A: An InsurTech startup leverages technology to innovate and improve the insurance industry. These startups offer digital solutions for buying, managing, and claiming insurance, enhancing the overall customer experience.

Q: How do InsurTech startups benefit customers?

A: InsurTech startups benefit customers by providing more convenient, transparent, and efficient ways to purchase and manage insurance. They often offer online platforms for comparing policies, streamlined claims processes, and personalized insurance products.

Q: Are InsurTech startups regulated in India?

A: Yes, InsurTech startups in India are regulated by the Insurance Regulatory and Development Authority of India (IRDAI). These regulations ensure that insurance products and services offered are safe, reliable, and compliant with industry standards.

Q: Can InsurTech startups integrate with traditional insurance companies?

A: Many InsurTech startups collaborate with traditional insurance companies to offer a wide range of products and services. These partnerships allow for the integration of innovative technology with established insurance practices, providing customers with the best of both worlds.

Q: How can I choose the right InsurTech startup for my insurance needs?

A: To choose the right InsurTech startup, consider factors such as the range of insurance products offered, user reviews, ease of use of the platform, customer support, and the startup’s reputation in the industry. Comparing different startups and their offerings can help you make an informed decision.

Last Updated on: Sunday, June 16, 2024 4:49 am by The Weekly News Team | Published by: The Weekly News Team on Tuesday, June 11, 2024 6:26 pm | News Categories: Startup