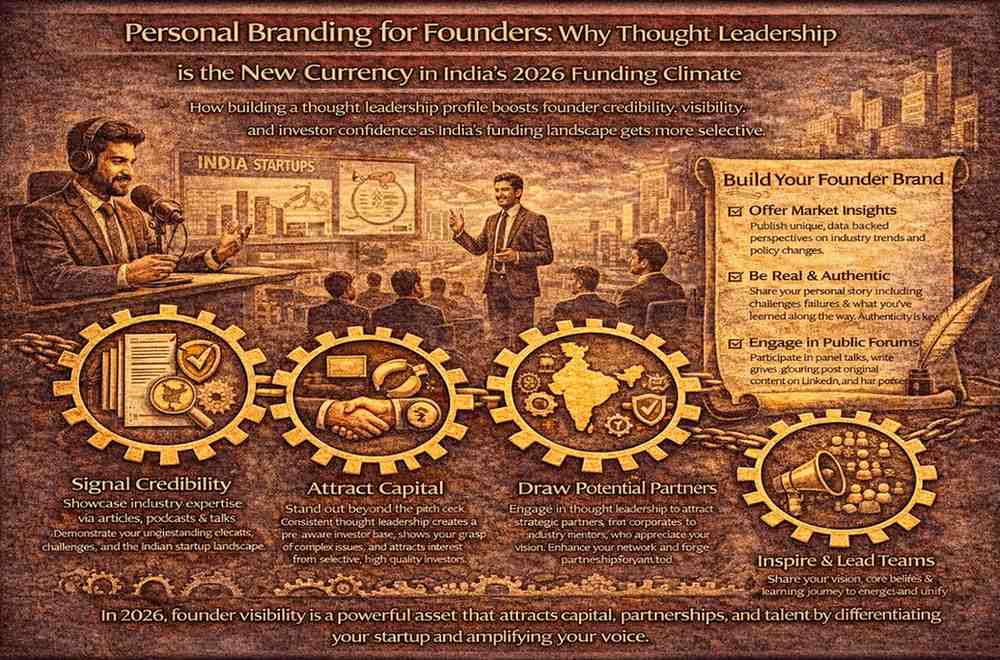

India’s startup funding landscape in 2026 looks very different from the boom years of easy capital and rapid valuations. Investors are more selective, due diligence is deeper, and trust has emerged as a decisive factor in funding decisions. In this environment, personal branding for founders is no longer a soft skill or a vanity exercise. Thought leadership has become a form of currency—one that influences credibility, deal flow, and long-term confidence in both the founder and the business.

Why Founder Visibility Matters More Than Ever

As capital becomes more cautious, investors are spending more time evaluating founders, not just financial projections. A startup’s vision, resilience, and execution capability are increasingly seen as extensions of its leadership. Founders who are visible, articulate, and consistent in their thinking offer investors greater comfort during uncertain market cycles.

In 2026, funding conversations often begin long before a pitch deck is shared. They start with how founders show up publicly—what they write, speak about, and stand for. Personal branding helps founders shape this first impression proactively rather than leaving it to chance.

Thought Leadership as a Signal of Credibility

Thought leadership is not about self-promotion; it is about demonstrating depth of understanding. Founders who share informed perspectives on industry trends, policy shifts, customer behaviour, and future challenges signal that they are close to the ground and thinking long term.

In India’s current funding climate, this matters deeply. Investors want to back founders who understand complexity and can navigate uncertainty. Regular, thoughtful insights act as proof of competence, helping founders stand out in crowded sectors where many startups look similar on paper.

The Shift From Pitch-Driven to Narrative-Driven Fundraising

Traditional fundraising relied heavily on structured pitches and closed-door meetings. While these remain important, the broader narrative around a founder now carries equal weight. Investors increasingly track founders over time through articles, interviews, podcasts, and social platforms.

A strong personal brand ensures that when fundraising begins, the founder is already familiar to the ecosystem. Their narrative—why they are building, what they believe, and how they think about the market—is already established. This reduces friction and shortens trust-building cycles.

India’s Unique Founder Branding Opportunity

India offers a distinct advantage when it comes to thought leadership. Rapid policy changes, digital adoption, and sectoral transformation mean there is constant demand for local, contextual insight. Global investors, in particular, look for founders who can explain India-specific nuances clearly and confidently.

Founders who position themselves as interpreters of India’s market realities—whether in fintech, SaaS, climate-tech, or consumer brands—create strong differentiation. This contextual authority is difficult to replicate and becomes a powerful asset during fundraising.

Building Trust Beyond the Balance Sheet

In a cautious funding environment, trust often matters as much as traction. Thought leadership humanises founders, allowing investors to understand their values, ethics, and decision-making style. This is especially important as governance, compliance, and long-term sustainability take centre stage.

Founders who speak openly about challenges, lessons learned, and trade-offs appear more credible than those who project only success. Authenticity strengthens personal brands and reassures investors that founders can handle adversity.

Role of Digital Platforms in Personal Branding

LinkedIn, founder blogs, industry forums, and media columns have become key channels for thought leadership. In 2026, these platforms are not optional—they are part of the founder’s professional footprint.

Consistency matters more than virality. Founders who share clear, well-reasoned perspectives over time build recognition and recall. This visibility often translates into inbound interest from investors, partners, and customers, reducing reliance on cold outreach.

Thought Leadership as a Long-Term Asset

Unlike marketing campaigns, personal branding compounds over time. A founder’s body of work—articles, talks, interviews—creates a track record of thinking that remains discoverable and relevant across funding cycles.

In India’s evolving startup ecosystem, this long-term visibility can support multiple outcomes, from fundraising and partnerships to talent attraction and policy influence. Thought leadership becomes part of the founder’s professional equity.

Avoiding the Trap of Performative Branding

While visibility is important, substance is critical. Investors and peers can quickly distinguish between meaningful insights and superficial commentary. Personal branding that focuses on trends without depth, or promotion without perspective, risks damaging credibility.

Successful founder branding in 2026 is grounded in real experience, data-backed views, and original thinking. It reflects how founders build, not just how they speak.

Impact on Early-Stage and Growth-Stage Founders

Thought leadership is not reserved for well-known founders. Early-stage entrepreneurs can benefit significantly by sharing learning journeys, market observations, and early hypotheses. For growth-stage founders, thought leadership reinforces scale readiness and strategic clarity.

Across stages, the common thread is trust. Founders who invest in their personal brand early often find it easier to attract aligned investors when the time comes.

What Investors Are Really Listening For

In today’s funding climate, investors listen for clarity of thought, realism, and conviction. Thought leadership provides a window into how founders process information, respond to change, and lead teams.

A strong personal brand does not guarantee funding, but it creates familiarity and confidence—two critical ingredients in high-stakes investment decisions.

The Road Ahead

Personal branding for founders is no longer optional in India’s 2026 funding climate. Thought leadership has emerged as a strategic tool that shapes perception, builds trust, and influences opportunity. As capital becomes more discerning, founders who invest in clear, authentic, and insight-driven personal brands will hold a powerful advantage.

Why thought leadership is the new currency is simple: money follows trust, and trust is built through consistent, credible voice. In a maturing startup ecosystem, founders who understand this shift will be better positioned to secure not just funding, but long-term belief in their vision.

Also read – https://theweeklynews.in/republic-day-celebrations-2026/

Add theweeklynews.in as preferred source on google – click here

Last Updated on: Tuesday, January 27, 2026 11:37 am by The Weekly News Team | Published by: The Weekly News Team on Tuesday, January 27, 2026 11:37 am | News Categories: India