Mumbai / Thrissur, India — Shares of South Indian Bank Ltd. plunged sharply this week following a leadership announcement that rattled investor confidence, marking one of the steepest single-day falls for the stock in recent months. The slump reflects how management changes in financial institutions can significantly impact market sentiment and stock performance.

Sudden Drop After CEO Signals Exit

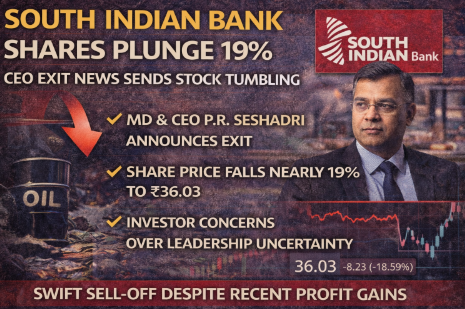

On 29 January 2026, South Indian Bank informed stock exchanges that its Managing Director & Chief Executive Officer (MD & CEO) P.R. Seshadri has decided not to offer himself for reappointment after his current term concludes on 30 September 2026. Seshadri, an industry veteran and former head of other private banks, communicated his intention to pursue personal interests, prompting a wave of investor selling.

Following the announcement, the bank’s shares tumbled nearly 19%, hitting a three-month low around ₹36.03 per share in intra-day trading — the most significant drop since recent record-setting runs. Traders noted heavy volume and elevated volatility as panic selling kicked in across market segments.

Market Reaction and Technical Signals

The sharp decline wiped out recent gains for the banking stock, which had delivered solid momentum over the past six months and one year, rising about 25% and 46% respectively before the fall. Technically, analysts observe that the share price fell below key moving averages, signaling near-term weakness and bearish sentiment, even as longer-term support remains near the 200-day average.

Intraday trading saw volumes spike — with nearly 7 crore shares traded and roughly ₹260 crore in value exchanged — suggesting active interest from both retail and institutional participants amid the sell-off. However, delivery volumes dropped, pointing to a higher proportion of short-term, speculative trades rather than long-term accumulation.

Why Investors Are Nervous

Investors typically view leadership stability as critical for banks, where strategic direction and risk governance play a pivotal role. Sudden departures or uncertainty at the senior management level often trigger concerns about continuity, execution of business plans, asset-quality oversight and future profitability. This appears to be the primary reason for the swift stock reaction despite the bank’s recent financial performance.

Financial Performance Overview

Interestingly, the price weakness comes despite solid underlying financials: South Indian Bank reported a net profit increase of about 9% year-on-year (YoY) to ₹374.32 crore for the December quarter, compared with the prior year. Pre-provisioning operating profit and non-interest income also rose, and asset quality metrics such as gross and net NPAs improved significantly compared to a year ago.

These favorable earnings trends suggest that the current downturn is driven more by sentiment and leadership concerns than fundamental deterioration, though technical traders continue to treat the stock with caution.

Broader Banking Sector Context

South Indian Bank’s slump contrasts recent periods of stronger performance, including times when the stock hit 52-week highs on robust growth reports and dividend policies. Prior technical breakouts had reflected stronger volume and institutional interest, underscoring the stock’s capacity for upward moves when sentiment improves.

Meanwhile, analysts reminding investors of historical buy recommendations with potential upside also indicate that the stock’s valuation metrics — including a relatively low price-to-earnings (P/E) ratio and improving asset quality — remain points of appeal for long-term holders once current volatility subsides.

What Happens Next? Management and Markets Watch Closely

The bank’s board has indicated it will initiate the process of identifying and approving a successor to P.R. Seshadri, pending necessary regulatory clearances from the Reserve Bank of India (RBI) and shareholder approvals. These developments will be closely monitored by markets in the coming weeks for signs of leadership stability.

Short-term traders remain cautious, watching levels like ₹36 support and ₹39 resistance on technical charts, while longer-term investors may focus on earnings momentum, asset-quality trends, and deposit/loan growth to assess future opportunities.

Summary

South Indian Bank’s share price experienced a sharp decline of nearly 19% after the lender’s CEO announced he would not seek reappointment, triggering a sell-off due to leadership uncertainty. This movement occurred even as the bank reported solid quarterly profit growth and improving asset quality, highlighting how market sentiment can outweigh fundamentals in the short term. Investors now await updates on the executive succession process and potential stabilisation in the stock.

Last Updated on: Friday, January 30, 2026 7:01 pm by The Weekly News Team | Published by: The Weekly News Team on Friday, January 30, 2026 7:01 pm | News Categories: News